Get real care on the road with DrivoTM Car insurance

Safeguard your daily journey with DrivoTM Car Insurance to enjoy exclusive accident assistance within 20 minutes from Income Orange Force to enjoy greater peace of mind.

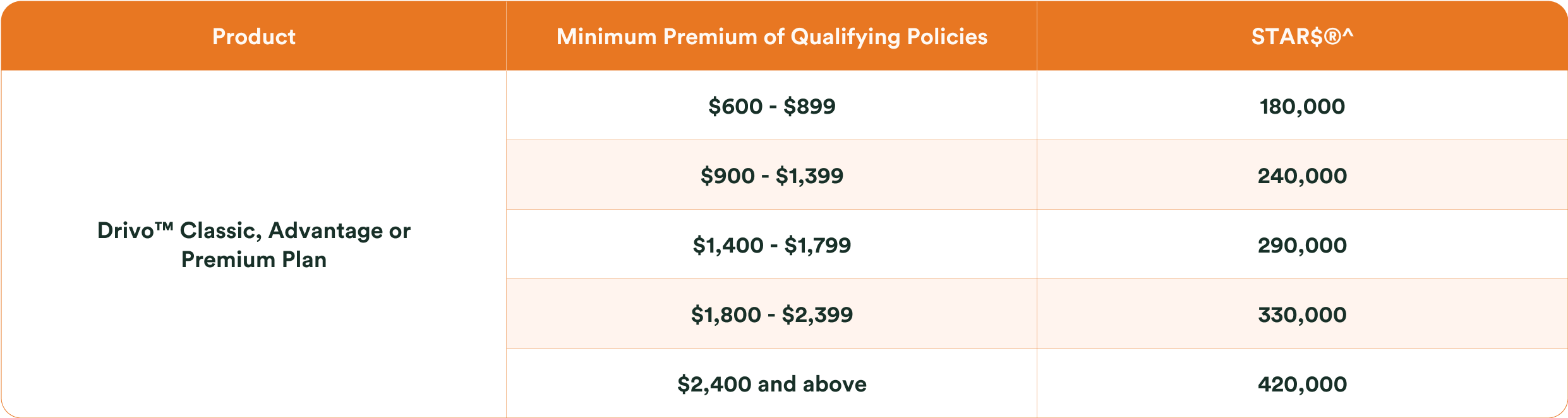

What's more? Purchase your Car insurance today and enjoy up to 420,000^ STAR$®.

Income Orange Force

No-claim discount protection

24/7 referral services in West Malaysia

Product highlights

Flexibility to choose your workshop

Get your car repaired at a workshop of your choice with DrivoTM Premium plan.

Unlimited windscreen cover

Stay protected on the road and enjoy peace of mind with unlimited windscreen cover.

Third-party property damages cover

Coverage for third-party property damages arising from accident.

The plans

At your preferred workshop

At DrivoTM Advantage authorised workshops

At authorised workshops chosen by Income Insurance

Motor insurance partnership

From the people who matter most

Trustpilot

Trustpilot

From the people who matter most

Trustpilot

TrustpilotQuick reads

^1,000 STAR$® = $1 eCapitaVouchers. Promo Ts&Cs apply.

This page is for general information only. You can find the detailed terms and conditions of this plan in the policy wording.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the LIA or SDIC.

This advertisement has not been reviewed by the Monetary Authority of Singapore.