Why choose Travel insurance that covers Pre-existing Medical Conditions?

A pre-existing medical condition (pre-ex) refers to a medical condition that you were aware of (or should reasonably be aware of), or that you received medical advice, treatment, diagnosis or prescription drugs up to 12 months before the start of your trip. Examples of common pre-existing medical conditions include asthma, diabetes, allergy and high blood pressure.

If you choose this cover, we will reimburse you for a claim that directly arises out of a pre-existing medical condition suffered by you, a family member travelling with you, or your travel companion (where applicable).

To purchase FWD Pre-existing Medical Conditions cover, start with getting a Travel insurance quote.

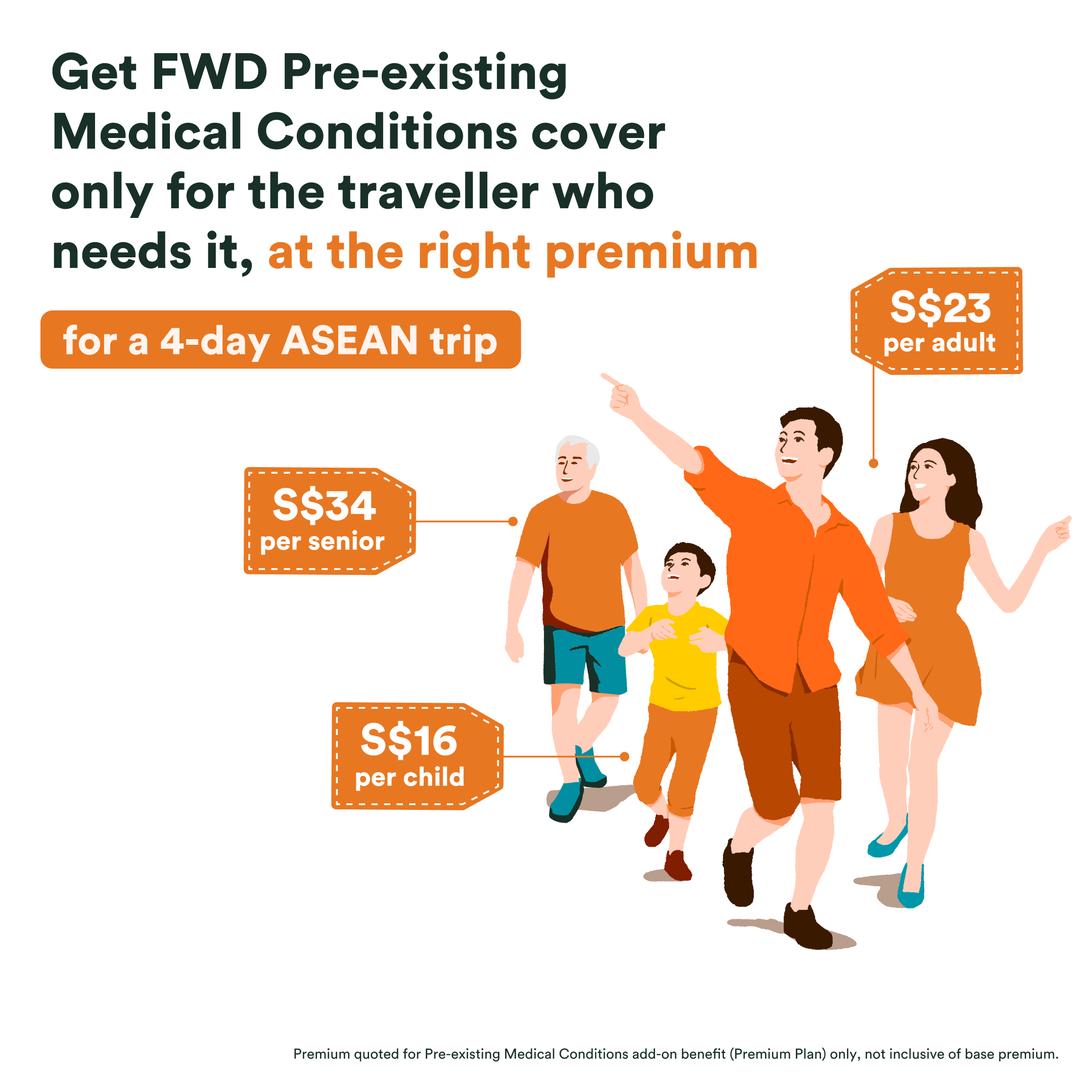

Affordable age-banded coverage

Zero excess for outpatient medical expenses

Coverage for trip cancellation

Product highlights

Coverage for overseas medical expenses and evacuation

Up to S$150,000 coverage for medical expenses incurred overseas and emergency medical evacuation due to pre-existing medical conditions.

Coverage for trip inconveniences

Up to S$15,000 coverage for benefits such as trip disruption, trip postponement and trip cut short (50% co-payment applicable) due to pre-existing medical conditions.

Automatic policy extension

If you’re medically unfit to travel or confined to a hospital overseas due to a pre-existing condition, we’ll extend your policy period, at no extra cost.

The plans

S$7,500

S$10,000

S$15,000

S$500

S$1,000

S$1,500

S$5,000

S$10,000

S$15,000

S$1,000

S$2,000

S$3,000

and

Emergency medical evacuation & repatriation

S$50,000

S$100,000

S$150,000

This page is for general information only. Please refer to the Policy Wording document for more details.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the General Insurance Association (GIA) or SDIC websites (www.gia.org.sg) or (www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Information is correct as at 20 May 2024.