Our top stories across FWD

What is trip cancellation? Does travel insurance allow you to claim for cancel for any reason?

5 min read

5 min read 25 October 2019

25 October 2019You’ve purchased your first car (congratulations!) — but now what? Buying car insurance can be needlessly complex, particularly when you aren’t sure what kind of coverage you may need. Whether you own a luxury model car or a secondhand vehicle, this guide covers everything you need to know about car insurance coverage and claims in Singapore.

Before getting into the thick of things, you might want to familiarise yourself with these car insurance terms:

In the event of an accident, ‘excess’ refers to the first part of the financial damage you will be responsible for. The insurer will then cover the remaining sum.

For instance, your vehicle bumps into another car, knocking off its fender. For this, you’re asked to foot a sum of $1,200. If your excess is $200, you’ll essentially only pay that amount — while your insurer covers the remaining $1,000. Choosing a higher excess will in most cases lower your premium.

It’s normal to get into small car accidents along the way. In fact, these are practically inevitable. But if your driving record is scotch-free, your car insurer may offer a discount on your premium over time — in what’s known as No-Claim Discount (NCD).

In the case of FWD Car Insurance, for example, the Lifetime NCD Protector is granted to drivers or car owners who don’t file for any at-fault claim over a period of five policy years.

The truth is, there is no fixed base rate for car insurance — your premium varies greatly depending on these factors:

Your age – If you’re under 27, be prepared for a higher excess of around $2,500. Drivers with at least three years’ experience typically enjoy lower premiums.

Marital Status – Married individuals who have people they care for, like their spouse and children, are likely more cautious when driving, that’s why premiums can cost less than that of someone who is single.

Driving experience and claims history – Drivers without a history of accidents, at-fault claims or demerit points may be granted lower premiums.

Car model and age of car – A basic car means a lower premium. Conversely, luxury cars (with higher engine capacities) will likely incur higher premiums.

Past claims experience – Having a good driving record without claims will get you a cheaper premium.

Current NCD – No claim discount, because you’ll pay less for your premium when your NCD is higher. And if you’re at 50%, you’ll keep it for life with FWD at no extra cost.

Demerit Points – with FWD, you’re rewarded for safe driving – you get a discount for your Certificate of Merit from the Traffic Police.

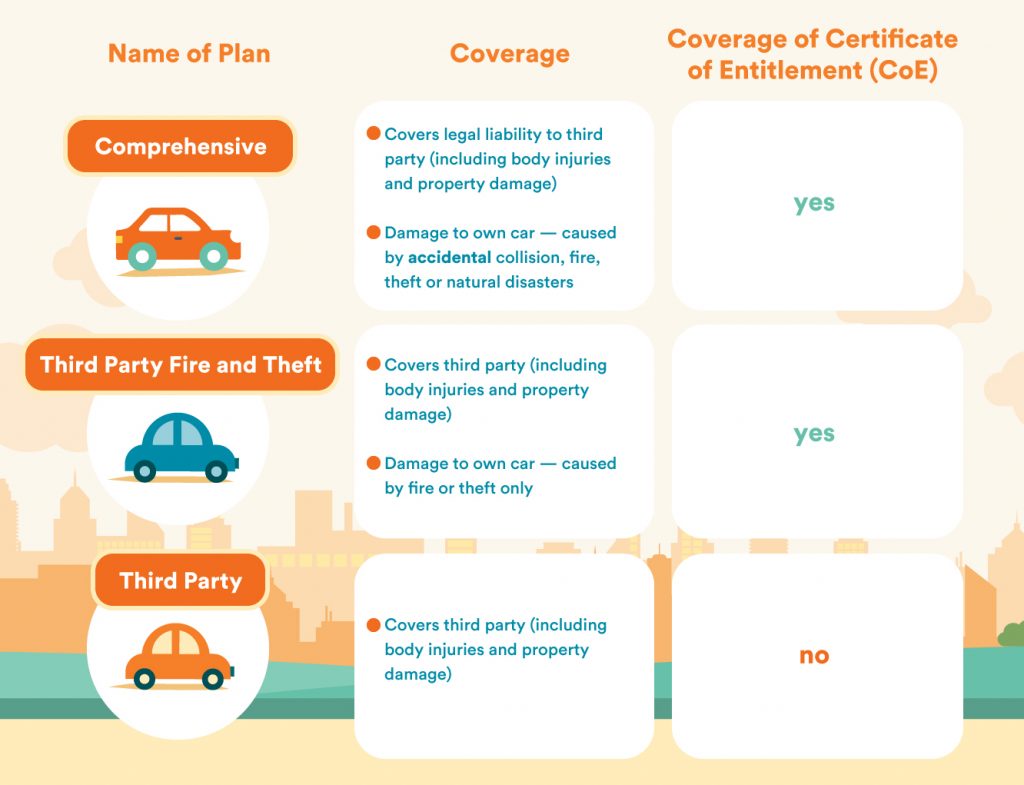

These are three basic plans to know in Singapore:

Note, however, the basic requirement in Singapore is Third-Party Insurance.

Additionally, if you’re still paying off your car mortgage, your bank may require you to get a comprehensive coverage plan. That’s because the car technically doesn’t belong to you until you’ve completed payment of the loan.

If you’re planning to use the car to drive into West Malaysia and parts of Thailand, a car insurance plan like FWD’s may benefit you.

It’s important to know the claims process before committing to a car insurance plan. Also, be aware that if you’re at fault in an accident, your NCD will be affected.

Assuming you are insured by FWD Car Insurance, claims can be made within minutes through the Click to Claim functionality online.

Alternatively, you’ll enjoy roadside assistance at all hours — simply call +65 6322 2072 to get assistance. For this, you’ll need to have proof of your driving license, NRIC and a soft copy of your Certificate of Insurance.

Most insurers offer a selection of car workshops for repairs. Likewise, FWD’s car insurance offers a complete list of premium workshops for your picking — and with an extended workmanship guarantee up until your car turns 10.

If you’ve purchased a new car, you might need to have your repairs done at the assigned workshop — or risk having your warranty forfeited. In such an instance, consider choosing the ‘Your Preferred Workshop Option’ add-on. This would then allow you to go to your preferred car workshop.

Unlike many insurers who require a Named Driver, anyone you trust to drive the car will be insured by FWD. Find out about the full benefits of FWD Car insurance here, and get a quote instantly!