Our top stories across FWD

What is trip cancellation? Does travel insurance allow you to claim for cancel for any reason?

5 min read

5 min read 18 July 2019

18 July 2019What is NCD and why is it a big deal to vehicle owners in Singapore? Well, it’s because you’ll get a discount on your vehicle insurance. That’s why it’s simply called “No-Claims Discount”, and when you don’t claim for any mishaps on the road for a full year, your NCD increases. This is a way to encourage you to be a better driver for everyone’s sake, and mostly yours.

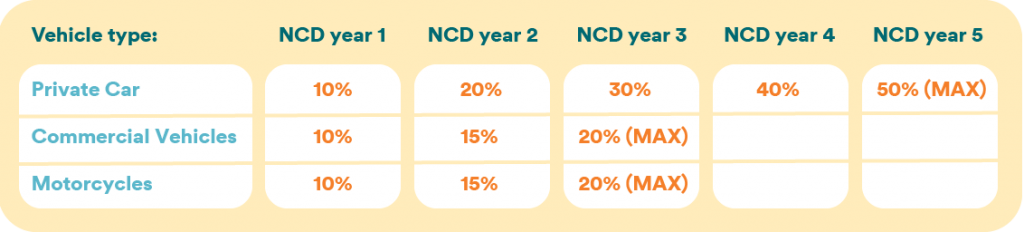

Your NCD increases annually, each time you renew, and you might already know this. Anyway, if you’d like a refresher or new to driving, let’s take a look at the different NCDs for each vehicle type in Singapore, and how much they increase each year if you make no claims:

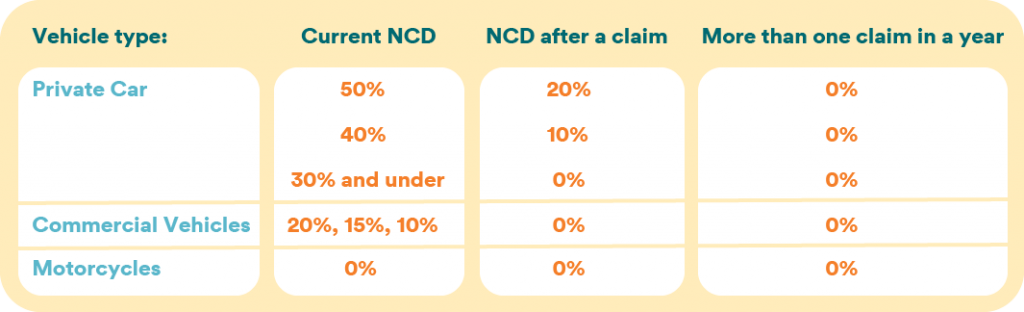

Now that you know how long it takes to earn your maximum NCD, what happens if you need to make a claim?

Nobody wants to lose their NCD, and insurers know that. Check with your insurer to find out how your NCD gets affected. Some insurers like FWD Singapore protect your maximum 50% NCD and let you keep it for life, meaning you don’t have to worry about losing it if you need to make a claim.

Yes, the NCD applies to you and not your vehicle, so, even if you switch cars, you can keep it. If you have more than one car, you may need to check with your insurer if the same NCD applies. Each vehicle you own may require you to earn separate NCDs.

If you change insurer, you can still keep your NCD. However, you can’t transfer your NCD to another person. Your NCD can be transferred to your spouse if you’re still with your current insurer and not when you renew with another insurer. You may want to check with your insurer to confirm if these rules have changed.

Typically, you’ll keep your NCD for up to 12-24 months, you can check the specific details with your insurer too.

If you don’t want to lose your NCD, there are insurers who can protect it, but often it comes with an additional premium. This means you can make a claim in a year and not lose your 50% maximum NCD for your private car. On the other hand, there are insurers like FWD who believe that good drivers who have 50% NCD shouldn’t be punished for making a claim, and offer lifetime guarantee without having to pay extra.

Want to keep your maximum NCD for life? Insurers like FWD offer lifetime NCD protection for private cars and motorcycles at no extra cost. Find out more about FWD insurance products and easily get a quote online.

The General Insurance Association of Singapore has more information if you’d like to read more about NCD and vehicle-related insurance topics.