Our top stories across FWD

What is trip cancellation? Does travel insurance allow you to claim for cancel for any reason?

5 min read

5 min read 24 September 2020

24 September 2020For many of us, four years usually mark a milestone in our lives. For example, you can complete your first university degree in about four years, depending on your chosen field. Most young Singaporeans also wait up to four years for their first BTO flats to be ready before getting married.

For FWD, four is definitely an important number, never mind what some people say about it being unlucky.

In fact, we’re proud to share that we have an average score of 4.6/5 or that 93% of our customers rate us 4 or 5 stars on Trustpilot.

Above all, we are chuffed to say that in just four wonderful years, we have earned the trust of more than 450,000 customers1 who have each experienced how we are changing the way you feel about insurance in Singapore.

Now, we get it. Many companies in the financial services sector in Singapore claim to be different and customer-centric. But here are the facts to back us up.

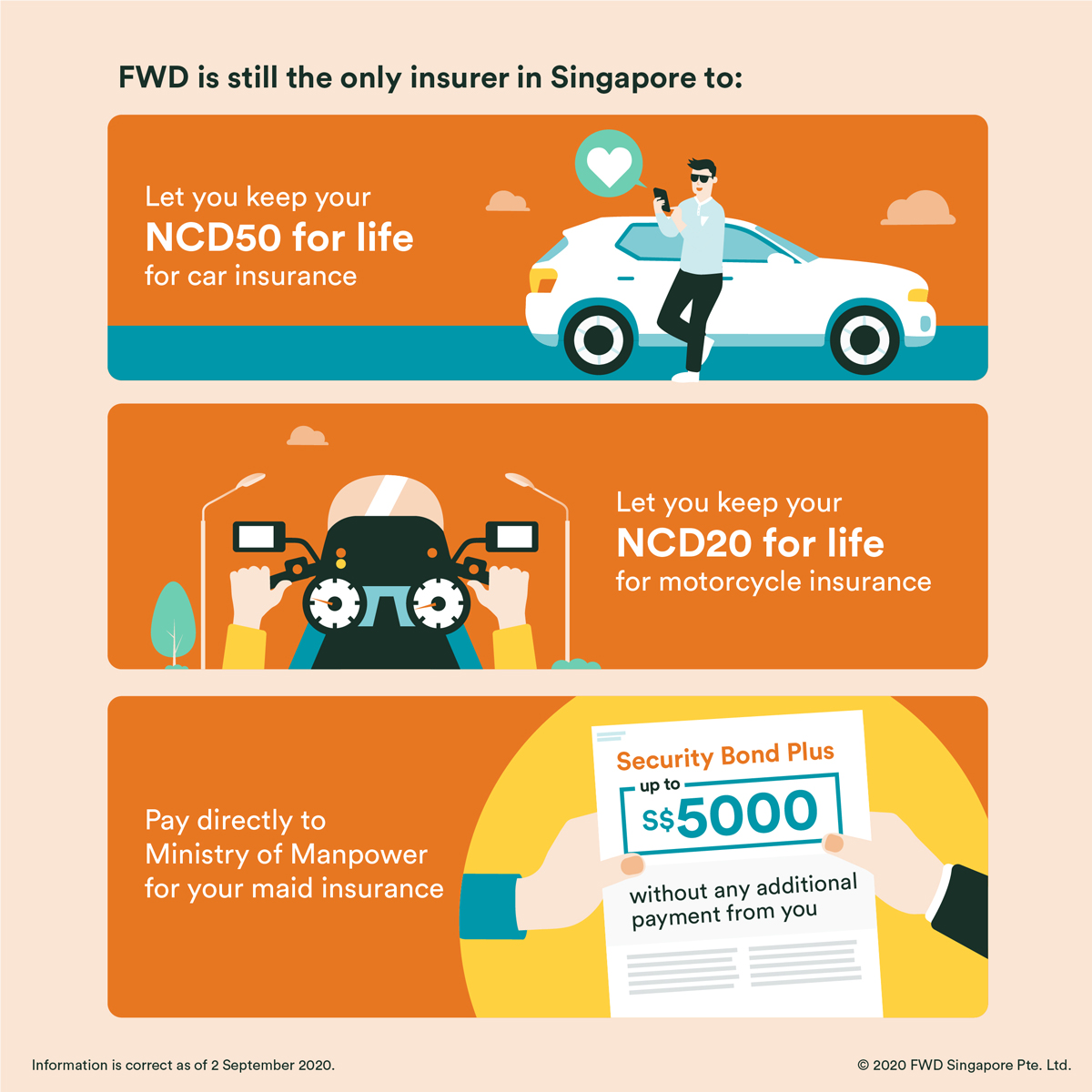

From being the only insurer in Singapore to let you keep your NCD50 and NCD20 for life for car and motorcycle insurance, to being the first in the market to let you enjoy cashless outpatient medical expenses or better yet, allow you to see a doctor from home, via virtual consultations, we’ve always let our innovations speak for themselves.

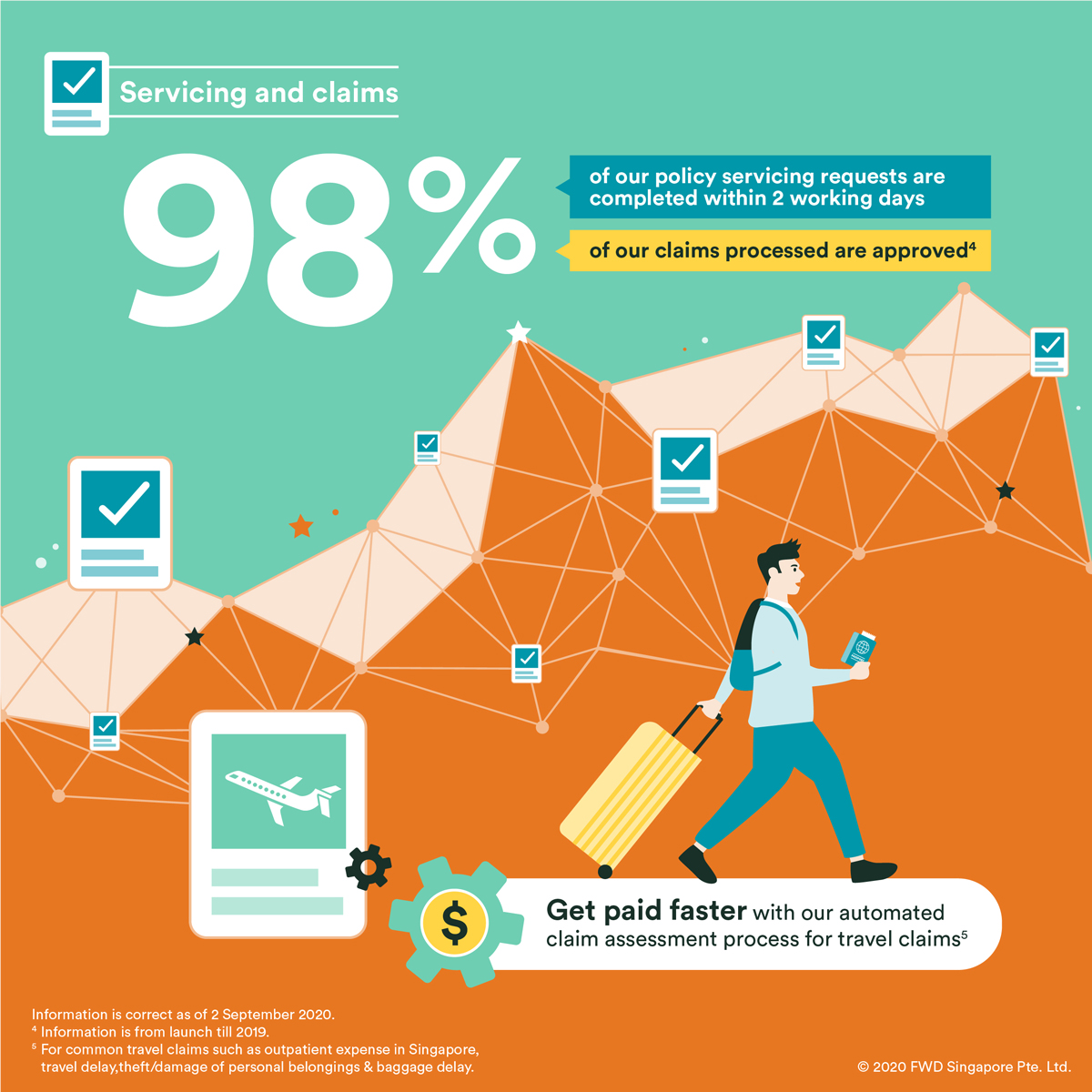

And if you say the proof of the pudding for insurance comes when you have a claim to make, you’ll be assured to know that we have approved 98% of all the claims we received from you are approved. Likewise, 98% of all policy servicing requests received are also completed within 2 working days2.

In fact, for common travel-related claims such as baggage delay or theft/damage of your personal belongings, we’ve fully automated the claim assessment process to ensure you get paid faster3.

Hey, even the authorities are placing their trust us – in 2019, we were appointed the official insurer by HDB to provide fire insurance to over 116,000 homes.

But we know that with COVID-10 putting a dent in our travel or even daily plans, now may be the time for you to put the focus on your well-being and safeguard what you have.

At FWD, we have similarly turned our attention to ensure that you have the means to stay financially protected, even when illnesses strike.

This is why we recently introduced the FWD Big 3 Critical Illness insurance to protect you against three common conditions that Singaporeans suffer from – Cancer, Heart Attack and Stroke, which account for 90% of all critical illness insurance claims in Singapore4.

For those who may wish to consult a financial advisor before signing up for a plan, we are working with partners such as IPP Financial Advisers and Finexis to provide you with the FWD solutions you are looking for. Be it online or offline, it’s the same simplified sales journey, with the on-the-spot issuance of your insurance policy that is enabled by Robo underwriting.

We are also helping to raise the standards of financial services in Singapore through a collaboration with INSEAD with an exclusive program for our top sales advisors. As the Government always say upskilling is a continuous endeavour!

Likewise, we’ll always try to do better for you.

Learn more about our journey in changing the way people feel about insurance here.