Our top stories across FWD

What is trip cancellation? Does travel insurance allow you to claim for cancel for any reason?

5 min read

5 min read 4 September 2019

4 September 2019At FWD, we embrace the convenience and do away with the complicated.

That’s why when we came to Singapore a little more than three years ago, we aspired to be the poster boy for a new approach to an old industry.

Since then we’ve not looked back. In fact, we worked very hard to change how you feel about insurance. In every way imaginable.

We became a bold disruptor that made Singaporeans (and our competitors) sit up and take notice.

We know what it feels like to be sharing your (sometimes awkward) lifestyle habits and quirks with a stranger. Over coffee, in a café filled with more strangers. It’s no fun.

So what did we do? We decided to move everything online, effectively allowing you to get your desired insurance cover, at your desired time and place. #NoFuss.

For general insurance, we’ve made it even easier.

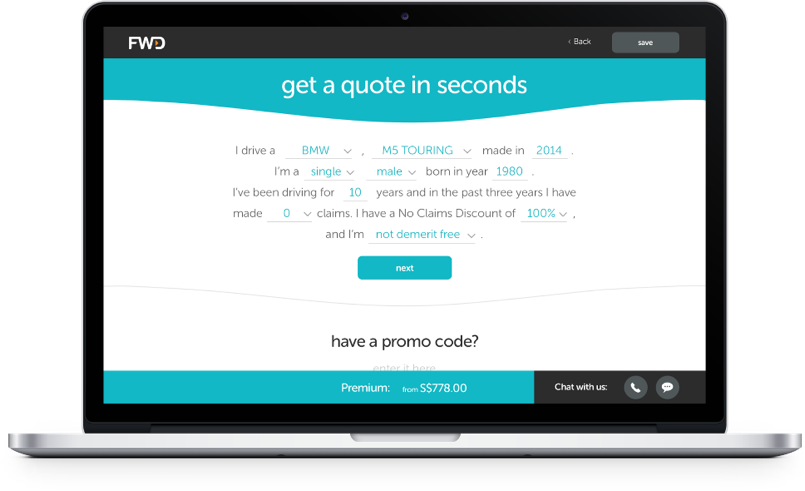

Remember the old days of having to plow through an endless “digital” form just to get a quotation for your car or travel insurance? Not cool.

So what did we do? We streamlined the process such that you only need to provide the relevant information to get your insurance quotation. To get a car insurance quotation on www.fwd.com.sg for example, you answer just 10 questions, compared to the more than 20 that other insurers still make you fill out.

Now, we get it. Some people say insurers/insurance agents are always quick to sell, but slow when it comes to processing or accepting claims. Not us.

In fact, we want to make it breezy for any customer to submit their claims to us. We studied the market and noticed many insurers provide only pdf forms which customers need to download and mail in to get their claim. So one of the first things we did was to do away with cumbersome paper forms (or PDF ones) for all 13 of our products.

Want to tell us about your delayed flight? Snap a photo and WhatsApp it to us!

If we can do away with paper forms, we can do away with paper cheques too. Once your claim is accepted and processed, we pay it to you via PayNow. No more missing cheques or waiting five days for the money to be banked into your account.

To make it even more convenient, customers of our Travel insurance plans need not even fork out money when they visit our panel of clinics for medical treatments. Just flash our E-Card and it’s done!

Customers of our Employee Benefits (EB) business enjoy perks too. In fact, FWD Singapore is the first insurer to allow corporate customers to request for Letter of Guarantee (LOG) 24/7 online from anywhere, with immediate issuance for certain cases, resulting in higher operational efficiency and better customer experience.

What’s more, FWD is the first corporate health insurer in Southeast Asia to adopt two AI solutions – one to read documents (HEAT OCR) and another to assess corporate claims (detecting fraud waste and possible abuse) thus helping companies pay only what is fair and required.

And to date, we have paid out more than 38,000 claims on our Direct-To-Consumer platform (which includes our Travel, Car and Home plans among the full list of 13 products); On the Employee Benefit front, the number stands at over 1,000,000 claims – that’s a whopping 98% of all the claims we received. #JustSaying.

We cover you from the workplace to your home and beyond.

If you are one of the many Singaporeans who employ a foreign domestic worker, you will be glad to know that FWD is, to date, the only insurer that offers an optional cover for your maid’s outpatient medical expenses, when she falls sick and needs to see a doctor. Talk about putting your mind at ease.

Singaporean drivers, too, will know about the importance of keeping your No-Claim-Discount (NCD) when you buy or renew your car insurance. At FWD, we believe good drivers shouldn’t be punished for an accident. That’s why we offer NCD for life for customers – 50% for car and 20% for motorcycles – once you have proven to be a safe and reliable motorist.

We take care of your health too.

In Singapore, cancer statistics can be sobering – About 1 in 5 Singaporeans is likely to develop cancer during his or her lifetime, according to the Singapore Cancer Society. With FWD’s Cancer insurance, we want to provide the financial resources for cancer patients to fight the battle and get back on the road of recovery.

That’s why our Cancer insurance product pays out 100% of the insured sum, once the patient is diagnosed – it doesn’t matter what type or which stage cancer may be.

With more and more people traveling the world for work, we developed a health product that follows you, wherever work takes you. Our International Health insurance plan gives you quality medical coverage, no matter where you are!

Because we understand you may have questions on your insurance plans any time of the day, we make sure we are always here to help.

Since the start of this year, our Chatbot, Faith, has been available 24/7, to answer your queries on our website, as well as on Google Home and Google Voice. She can even help you process your Travel insurance claims. Psst: We hear there will soon be even more things Faith can help you with. So stay tuned!

We do all these things because we want to change the way YOU feel about insurance.

And so far, we are extremely gratified that people who have tried us, love us! Already, we are consistently among the top five most considered insurers in Singapore, ahead of industry giants whose names we shall not mention (let’s play nice).

We also boast one of the highest renewal rates in the industry, with a more-than-healthy renewal percentage of 77%, comfortably ahead of the market’s prevailing 60%.

We think one reason for this is our willingness to be open with you and everyone else. We use Trustpilot – an independent review mechanism widely adopted by different industries – to allow customers to give us real, unedited feedback. Our score? 9.1/10.

Likewise, when we engaged Forrester Research to conduct an annual benchmark of customer experience quality among insurance companies in Singapore (most of whom are large global brands), FWD scored 15 points above the industry average.

This is why FWD is the top direct and digital Travel insurer in Singapore, also sixth* biggest Travel insurer in Singapore by market share.

This is also why, in just under three years, we now have over 300,000 customers, who have experienced our brand of insurance.

We have been a disruptor, but now we are ready to take on the big boys and beat the incumbents. And this is exactly what we did when we marched ahead of other major insurers, including companies that have been around for decades, to become HDB’s appointed HDB Fire insurer for the next five years.

On the EB front, we ensure the healthcare needs of hundreds of thousands of employees in Singapore, with leading local firms among those who have entrusted their needs with us.

And we are not done yet. Far from it. In fact, we want to continue surprising you with products and experiences that are Simple, Reliable and Direct.

Above all, we want to thank you for trusting us with your insurance needs. We are turning three because you made it possible!

So here’s a token from all of us at FWD Singapore: Enjoy 30% off all FWD products at www.fwd.com.sg

We Are FWD. We Are Different.

*Based on GIA’s Q2 2019 statistics

This article is for general information only. You can find the detailed terms and conditions of the plans in the policy wordings.