Our top stories across FWD

What is trip cancellation? Does travel insurance allow you to claim for cancel for any reason?

5 min read

5 min read 26 August 2021

26 August 2021When you’re the employer of a foreign domestic worker, you are obligated to provide medical and personal accident coverage. In a way, this is not dissimilar from a company providing medical insurance to its employees. However, while companies usually offer medical insurance to entice prospective employees and to make sure their employees are well taken care of, employers of domestic helpers are required to buy maid insurance and thus prioritise low-priced policies over high value options. So, what happens when an emergency strikes, and your policy fails to cover a hospital bill or an unexpected expense? We discuss 3 essential things that your maid insurance should cover.

While Singapore has a generally affordable healthcare system for its citizens, temporary workers don’t get the same subsidies and benefits that allow for the same reductions in healthcare fees. Factoring in the increasing costs of medical care, it’s better to pay a bit more for your insurance plan than be underinsured and face thousands of dollars in out-of-pocket costs when your domestic helper is involved in a sudden accident.

Even more importantly, you will need to pay for all your helper’s health conditions, including pre-existing ones. Unfortunately, nearly all insurers will exclude pre-existing medical conditions from coverage, which means you’ll need to pay out-of-pocket if your worker’s condition flares up due to her job duties. Getting insurance that provides a hospitalisation coverage that’s above the minimum of S$15,000, as well as coverage for pre-existing conditions will help protect you financially if anything were to happen. For instance, a plan like FWD Maid insurance offers a hospitalisation coverage of up to S$25,000 and is the one of the few insurers who provides coverage for pre-existing conditions without paying extra1, so you can have peace of mind when hiring a helper suitable for you.

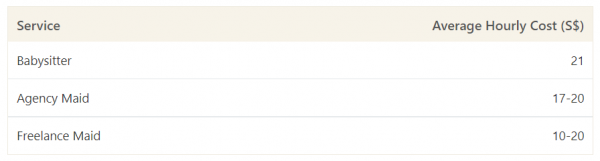

You’ll also need to consider the tangential costs of your helper having to stay in the hospital or getting sent home early. For instance, while you may have enough hospitalisation coverage to cover the medical bills, what about the costs of paying your helper’s salary, getting temporary help or re-hiring a new helper? For instance, a babysitter in Singapore costs S$21 per hour and a freelance maid can cost S$10-S$20 per hour. Having a policy that provides benefits for alternative maid services will offset at least some of the cost of hiring a temporary helper while your helper heals. Furthermore, since you will still be liable to pay your helper’s salary while they’re in the hospital, you will end up with a significant daily cost outlay that could have been avoided had your maid insurance plan covered these expenses.

Average Cost of a Part-Time Maid

Source: ValueChampion

It is also important not to overlook the expenses of hiring a new helper as it can cost around S$1,400. A maid insurance plan that offers coverage for maid agency fees can also provide substantial help during a stressful period.

Given that we’re still in the middle of a pandemic, it would be prudent to extend COVID-19 protection to your helper as you will need to ensure that her healthcare needs are taken care of if she gets infected with COVID-19. Therefore, getting coverage for hospitalisation fees incurred from COVID-19 treatments can save you from heavy out-of-pocket costs. In the event of death or disability, sending your helper home can be yet another costly affair, which is why your maid insurance plan should also cover repatriation expenses to help her return home. A COVID-19 add-on like FWD’s provides coverage of up to S$15,000 hospitalisation expenses and up to S$10,000 repatriation expenses if your helper is contracted with COVID-19 within 14 days of arrival in Singapore.

You should always take the time to consider if a policy fulfills your requirements as an employer. At the end of the day, the maid insurance policy you choose should provide enough coverage for you and your helper so that if something unexpected were to happen, you’d be protected. FWD Maid insurance offers plans that consistently cost below the market average and offers all the benefits discussed above.

If you already have maid insurance for your domestic helper, you can still supplement her insurance cover with independent add-ons from FWD. You can opt for extra coverage to further suit your needs such as cashless outpatient medical expenses, six-monthly medical examination (6ME) and performance bond for Philippine Embassy.

Getting your helper insured is simple with FWD. Get a quote for our Maid insurance within a few minutes here.