Our top stories across FWD

What is trip cancellation? Does travel insurance allow you to claim for cancel for any reason?

8 min read

8 min read 24 May 2021

24 May 2021This article was originally published on ValueChampion.

Life-changing events, like a critical illness diagnosis, are impossible to ignore. But how much do Singaporeans know about critical illness (CI) coverage? According to the latest Protection Gap Study by Life Insurance Association Singapore, Singapore has a mortality protection gap and CI protection gap of about S$169,673 and S$256,826 per economically active adult, respectively. This amounts to a national mortality and CI protection gap of S$893 billion. The protection gap estimates the lack of protection against financial consequences of events such as death or CI.

As startling as these figures may seem, one thing’s for certain: Singaporeans are not adequately covered for CIs, and this gap could imply a lack of understanding and awareness around CI coverage. Here are some common myths about CI coverage and the truth behind these claims.

Is it true that CI premiums are too expensive for those fresh to the workforce? Contrary to popular belief, it is relatively affordable for young working adults to purchase CI coverage, especially when you are healthy and free of illnesses. For example, you can purchase FWD Big 3 Critical Illness insurance from as low as 1/3 the price of a regular CI plan in Singapore.1

To put this into perspective, purchasing this CI plan will only set you back as little as S$18 per month, in exchange for $50,000 coverage (for a 35 year old non-smoking male). That’s probably less than your monthly phone bill, no? What’s more, you can choose between S$50,000, S$100,000 and S$200,000 of coverage for cancer, heart attack, and stroke, with no medical examination and just one simple health declaration.

And if you think only older people suffer from a CI, you may be shocked to learn that you can be struck with a critical illness even as early as your twenties.

Apart from enjoying a low and affordable premium, purchasing a CI plan is also an important step in your financial planning journey to ensure that you’ll be financially prepared in the event of an unforeseen illness. With the right plan, getting covered for CI can be affordable regardless of whether you’re in your 20s or your 50s. So, why not start early in safeguarding yourself against severe illnesses in the future?

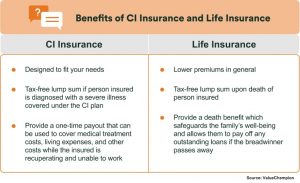

If you’ve ever wondered if a critical illness plan is necessary if you already have a life insurance plan, this next part is for you. While it is true that both types of insurance bear certain similarities such as offering a lump sum payout, we share a few helpful differences below.

That said, both types of insurance are worth considering as they complement each other to create a financial safety net for your family during uncertain times. For instance, a standalone CI plan could be paired with an existing life insurance plan for an extra layer of protection.

While some health conditions are genetic, others may be caused by factors in our environment or our lifestyle. According to a study, Singapore currently has the 3rd highest life expectancy in the world and the average life expectancy in Singapore is expected to increase, along with the rate of critical illnesses. As we live longer, we’re also spending more time in ill-health — 10.6 years to be exact, according to the same study.

Here are a few statistics about CI in Singapore:

While it’s important to be aware of health trends in Singapore such as a longer life expectancy and a rise in critical illnesses, don’t let these statistics scare you. Instead, start taking steps to plan ahead for your financial future. Getting covered for CI is one way to financially protect yourself and your family in case of a severe illness in the future.

When it comes to CI insurance, there’s no one size fits all approach. That’s why it’s important to do your research and find a plan that best fits your needs. If you’re seeking financial protection for heart attack, stroke and all stages of cancer with a one-time full payout, FWD Big 3 Critical Illness insurance may be a good place to start.

Check FWD Big 3 Critical Illness insurance price easily and buy online today without the need for any medical examination.

1 Information correct as of 25 June 2020. Base plan comparison is for All stage Cancer, late stage Stroke and late stage Heart attack against similar plans (not identical) in the market.

This article is sponsored by FWD Singapore.

This is for general information only and does not constitute financial advice.

Buying a life insurance policy is a long-term commitment. You should consider if this policy is suitable for your needs, or you may wish to seek advice from a qualified financial adviser before making a commitment to purchase this policy. Switching from an existing policy to a new one may have potential disadvantages.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). This advertisement has not been reviewed by the Monetary Authority of Singapore.