Our top stories across FWD

What is trip cancellation? Does travel insurance allow you to claim for cancel for any reason?

6 min read

6 min read 27 May 2020

27 May 2020In life, everyone goes through various rites of passage: your first job, getting a driver’s license, voting, getting married, and buying a home for the first time. Then there’s getting your first insurance policy — an intimidating step that involves comparing an overwhelming number of plans and insurance types. To simplify things, we examine the differences between two key insurance types: term, and whole life.

Simply put, a life insurance policy secures your family’s financial future against unforeseen events. These could include critical illness, death, or circumstances leading to permanent disability.

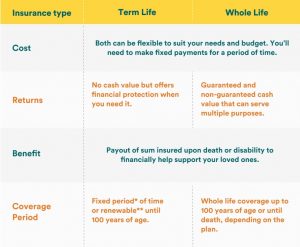

The following table shows the key differences at a glance.

*FWD Fixed Term Life insurance: Premium always stays the same until the end of the policy for a specific period. e.g. 5 years, 10 years, 20 years.

**FWD Renewable Term Life insurance: Starts with a low premium and increases with age. Flexibility to renew until age 100.

That depends on your age, income and protection needs.

Let’s paint the scenario of a 23-year-old female named Ashley — a young working adult who is looking for her first life insurance policy. As she has no dependents and few financial commitments, she can set aside funds for a whole life plan that can provide her with both protection and savings in the future, when she will eventually have the need for it. As she is in her early 20s, it is likely her insurance premium will be lower because of her age. As her whole life premium is fixed, her plan can eventually become more affordable to her as her income increases.

In an alternative scenario, Ryan is a 40-year-old sole breadwinner of his family, with a son who just started studying in a university — in addition to other financial obligations, such as repaying his housing and renovation loans. Ryan wants his family to have their protection needs covered, especially education for his son’s future. In this crucial time, Ryan uses an online insurance calculator, to compare whole life and term insurance. Ryan decides that a fixed term life insurance plan offers him a cost-efficient blanket of protection for his loved ones while balancing his family’s living expenses during this critical period of about 5 years.

In the case of FWD Term Life Plus insurance, Ryan has the option of buying a fixed term life insurance which offers protection for a fixed period of time, or renewable term coverage that would give Ryan the option of extending his term life insurance at any point. For less than S$1 per day, he can have a sum insured of S$500,000 to secure his family in the next 5 years.

Ashley and Ryan both have different needs and budgets, your needs might also be different – choosing the right insurance can be aided by tools such as LIA’s insurance calculator.

FWD’s Term Life insurance lets you choose a sum insured for your protection needs of up to S$3 million. You can also opt to buy up to S$1.5 million of coverage without the need for a medical check-up if you are in the pink of health. Find out how much your sum insured cover is by getting a Term Life Plus insurance quote online, in a matter of seconds, it’s that easy.

This is for general information only and does not constitute financial advice.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). This advertisement has not been reviewed by the Monetary Authority of Singapore.

Buying a life insurance policy is a long-term commitment. You should consider if this policy is suitable for your needs, or you may wish to seek advice from a qualified financial adviser before making a commitment to purchase this policy. Switching from an existing policy to a new one may have potential disadvantages.