Our top stories across FWD

What is trip cancellation? Does travel insurance allow you to claim for cancel for any reason?

6 min min read

6 min min read 16 December 2023

16 December 2023As we progress along the journey called life, from carefree days in our youth, to the steady years of adulthood, to the golden years of retirement, we will inevitably encounter different challenges and opportunities at each stage of our lives.

Whether you’re caring for loved ones, such as elderly parents at home, or handling new financial responsibilities, certain aspects merit protection. This is precisely what life insurance aims to cover. It provides a financial payout in the event of unforeseen situations, such as terminal illness or unexpected death. Think of it like financial protection for your family, shielding them from financial burdens such as outstanding loans that they may have to take on if you’re no longer around.

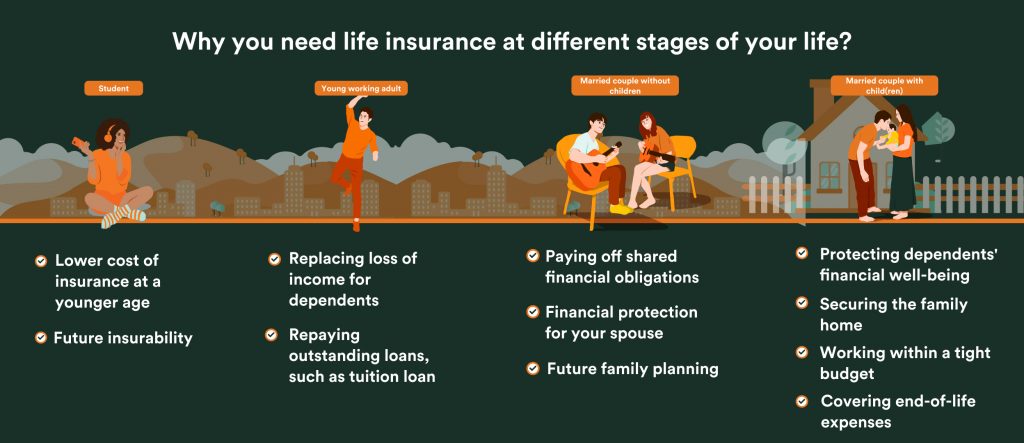

Here’s some reasons why you should consider life insurance as you progress through your life stages.

Student life is a whirlwind of opportunities and exciting encounters – from academic pursuits and co-curricular activities to internships and explorations into side hustles. Amidst the vibrancy of undergraduate life, some students may not see why life insurance is important. But thinking about it early can be a smart move.

When it comes to life insurance, being younger often means paying less. That’s because when you’re young, you’re usually healthier and less likely to have health issues at the point of purchasing your insurance. It’s like a perk of being young and healthy, so why not take advantage of it? Your future self might just thank you for it.

Securing life insurance while you’re young ensures ongoing coverage for potential future health issues. As you get older, the likelihood of health problems like stroke or heart attack increases, so delaying the purchase of life insurance until later in life, especially if you have an existing medical condition, can significantly complicate or increase the cost of getting insured. In some cases, your insurance application might get rejected. That being said, there are some insurance plans that offer flexibility to increase your coverage, without the need for medical examinations, when you reach significant life milestones.

As you enter a new lifestage and get your first real job, the learning curve is steep, and the responsibilities are aplenty. Taking charge of your finances may seem daunting to most young working adults, but it’s the first step to building a stable foundation for your future. It is an opportune time to consider life insurance as a key part of financial planning.

As your career moves forward and you pitch in more for your household income, the responsibility of supporting your parents may start falling more on your shoulders. It’s important to provide for that safeguard so your parents can be looked after in the unfortunate event that you’re no longer around. The payout from your life insurance policy can support your parents through challenging times by covering household expenses and easing financial stress.

In Singapore, local university tuition fees1 range from S$20,000 to S$50,000, while private universities may set you back by S$15,000 to S$100,000. These are by no means a small sum to most. If your university education was financed with tuition loans, there might be a significant balance remaining after graduation. Life insurance may provide the financial means to service a portion of these outstanding loans if you pass away or become terminally ill.

As you step into this new chapter of life, your journey with significant other naturally takes centre stage. With these shifts, your financial situation and priorities might undergo some changes too. Although it’s a bit different from the scenarios with kids or a larger family, here’s how life insurance plays a role in this new chapter of life.

In a marriage, it’s common for partners to handle finances together, paying for items such as car and home loans. If you face a terminal illness or pass away, handling these financial responsibilities alone can be a strain for your surviving spouse. Life insurance can offer support to your surviving spouse in managing these shared financial obligations as they grapple with the emotional side of things too.

Life insurance acts as income replacement, allowing your partner and parents to sustain their current lifestyle should something unexpected happens to you, especially if you contribute significantly to the household income. The life insurance payout serves as ongoing support for your partner when you’re no longer able to be there for them.

While you may not have kids at the moment, it is a smart idea to consider life insurance for future family planning, especially if you plan to expand your family in the future. Getting term life insurance now also helps you to lock in lower premiums for the future as you’re younger.

Being a parent is no small feat, but the journey of raising a child is filled with immeasurable joy and love. We understand the multitude of responsibilities that come with parenting, including wanting to provide well-being and security to our families. Here’s why you might need life insurance.

As parents, we all want the best for our kids, especially when it comes to their financial well-being. This becomes even more crucial when they’re still little. With life insurance, you’re financially protecting their well-being, and have the assurance that they’ll be supported until they reach young adulthood, including through their university years, facilitating their journey toward independence.

Mortgage loans can be a significant financial commitment for many families. Life insurance payouts are designed to cover any remaining mortgage balance, reducing the risk of foreclosure. This gives reassurance that, be it you or your partner, your family can continue living in comfort without worrying about money even if the main breadwinner is no longer around.

Being a young family often means dealing with tight budgets and navigating financial challenges. Life insurance can be tailored to your budget and needs. This ensures that you have the necessary coverage while having sufficient financial flexibility to meet other financial goals.

End-of-life costs, such as funeral expenses or hospice care, can be substantial. In Singapore, funeral expenses range from S$1,300 to S$8,4002, and inpatient hospice care, providing medical and palliative services for terminally ill individuals, is estimated at S$7,000 a month3. The payout from life insurance acts as a financial safeguard, alleviating the stress and concerns associated with end-of-life expenses for your dependents.

Considering this, the relevance of life insurance extends across various stages of life, whether you are a student, working adult, husband, wife, or parent.

At different life stages, you will find yourself having different goals and needs. However, life insurance remains a foundational element of financial security and peace of mind, benefiting both you and your family.

FWD Term Life Plus insurance provides affordable financial protection for your loved ones, from as low as a month4. Get covered in minutes for up to S$1.5 million directly online, without any medical examinations if you’re in the pink of health.

You can take comfort knowing that even in your absence, your loved ones can take care of outstanding debts, maintain their lifestyle, fulfil their dreams, and secure their future; they will be financially supported and protected.

Purchasing life insurance is more than just a smart financial move; it is a testament to your commitment to safeguarding the well-being of your loved ones and their future.

1 https://blog.seedly.sg/university-fees-singapore/

2 https://singaporelegaladvice.com/law-articles/death-registry-autopsy-funeral-expenses-singapore/

3 https://www.healthhub.sg/live-healthy/125/inpatienthospicecareaic

4 For a female, non-smoker, aged 18 with a sum insured of S$100,000 for a yearly renewable term. Price rounded to the nearest whole number.

This article contains only general information and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person. This shall not constitute as financial advice. You may wish to seek advice from a financial adviser representative for a financial needs analysis before purchasing a policy suitable to meet your needs.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact us or visit the GIA/LIA or SDIC websites (http://www.gia.org.sg/or http://www.lia.org.sg/or http://www.sdic.org.sg/).

Information presented shall not be distributed, modified, transmitted, reused, reposted, or be used for public or commercial purposes, including the text, images, audio, and video without the consent from FWD Singapore Pte. Ltd. This advertisement has not been reviewed by the Monetary Authority of Singapore. Information is correct as of 13 December 2023.