Our top stories across FWD

What is trip cancellation? Does travel insurance allow you to claim for cancel for any reason?

5 min read

5 min read 15 November 2023

15 November 2023With the year drawing to a close and the travel season edging nearer, it’s the perfect time to plan your next holiday. Whether it’s a family adventure, a romantic getaway, or a solo journey to your dream destination, there’s one crucial aspect of your trip that shouldn’t be overlooked: travel insurance.

There’re many considerations when purchasing a travel insurance, and one of the more crucial considerations would be to understand the extent of trip coverage. It’s helpful to know about the scope of coverage for each stage of the trip – from trip cancellation, trip postponement and trip cut short – and what specific events are covered under each.

In this article, you’ll learn about travel insurance, the different considerations for trip protection, as well as an additional form of trip coverage that gives you the flexibility to cancel your trip for any reason.

Trip cancellation coverage (also referred to as travel cancellation coverage) is a common benefit found in most travel insurance plans. If you’ve to cancel, postpone or cut short your trip due to unforeseen circumstances, this coverage comes in handy. It allows you to claim the expenses associated with your bookings, such as flights.

Why is this important? Well, big-ticket items like airfare and accommodation can quickly add up and canceling your travel plan after making bookings and payments could mean taking a hit on the wallet. It’s also a disappointing situation, especially if you’ve been eagerly looking forward to your long-awaited holiday. However, with travel cancellation coverage, you can still salvage a portion of the money you’ve paid, which hopefully makes you feel better about your holiday cancellation.

Here are three common travel cancellation coverage that protect your travel plans.

This is the most common type of coverage for travel plans and provides reimbursement if you need to cancel your trip before it starts because of unexpected events like a serious injury or a family death at home.

Trip postponement coverage offers you flexibility when you have to delay your travel plans due to unexpected situations.

In other situations, your travel plans can take an unexpected twist, requiring you to return home earlier than anticipated. Your travel insurance will reimburse expenses related to your early return.

Typically, your travel insurance will reimburse for upfront expenses that are non-refundable, but the extent of coverage varies from insurer to insurer.

Some travel insurance policies may concentrate solely on non-refundable travel and accommodation reimbursements. Others, like, FWD Travel insurance, offer a broader scope for trip cancellation claim to also include other pre-paid expenses associated with your trip that are also not refundable, such as tour packages.

Your holidays don’t always go as planned, sometimes you may have to cancel, postpone or cut short your trip. In such cases, you could file a travel insurance claim to seek reimbursement.

To speed up your claims assessment, it helps to prepare the necessary documentation to support your case.

Typically, the following documents are required for a travel cancellation claim.

– Trip-related invoices, such as tour booking invoice, ticket confirmations, or boarding passes

– Original invoices and receipts for expenses incurred

– Confirmation from the travel agency or airline indicating the cost of non-refundable prepaid travel expenses

– Medical reports and supporting evidence from the attending healthcare provider confirming the traveller’s unfitness to travel (in cases of severe injury or illness)

– Death certificate of the policyholder or insured person’s family members (if relevant)

In addition to providing these documents, it’s crucial to ensure that you’re claiming under the appropriate benefit and for the correct amount.

Travel insurance typically accepts specific reasons for trip cancellation, trip postponement and trip cut short. Some common reasons that are usually accepted:

You or a travel companion become medically unfit to travel due to injury or illness, or a family member faces a life-threatening injury or illness.

Your or your travel companion’s home is significantly damaged from fire or a natural disaster, preventing travel or necessitating an early return.

Your flight is cancelled due to airport closures or poor weather, forcing airplanes to be grounded

You must serve as a court witness during your scheduled travel period.

For instance, if you fall seriously ill during your trip or your home is damaged by fire, you can claim for a trip cut short or cancellation and seek reimbursement for your holiday cancellation.

However, life’s twists and turns can also throw unexpected challenges your way, such as sudden work commitments or family matters that require you to change your travel plans. While these reasons may be genuine and valid, they often fall outside the scope of standard travel insurance coverage. In these cases, you might not be covered in such situations.

If you’re looking for a travel insurance plan that covers a broader range of situations, offering greater safeguards for various unexpected situations, we’ve got you covered.

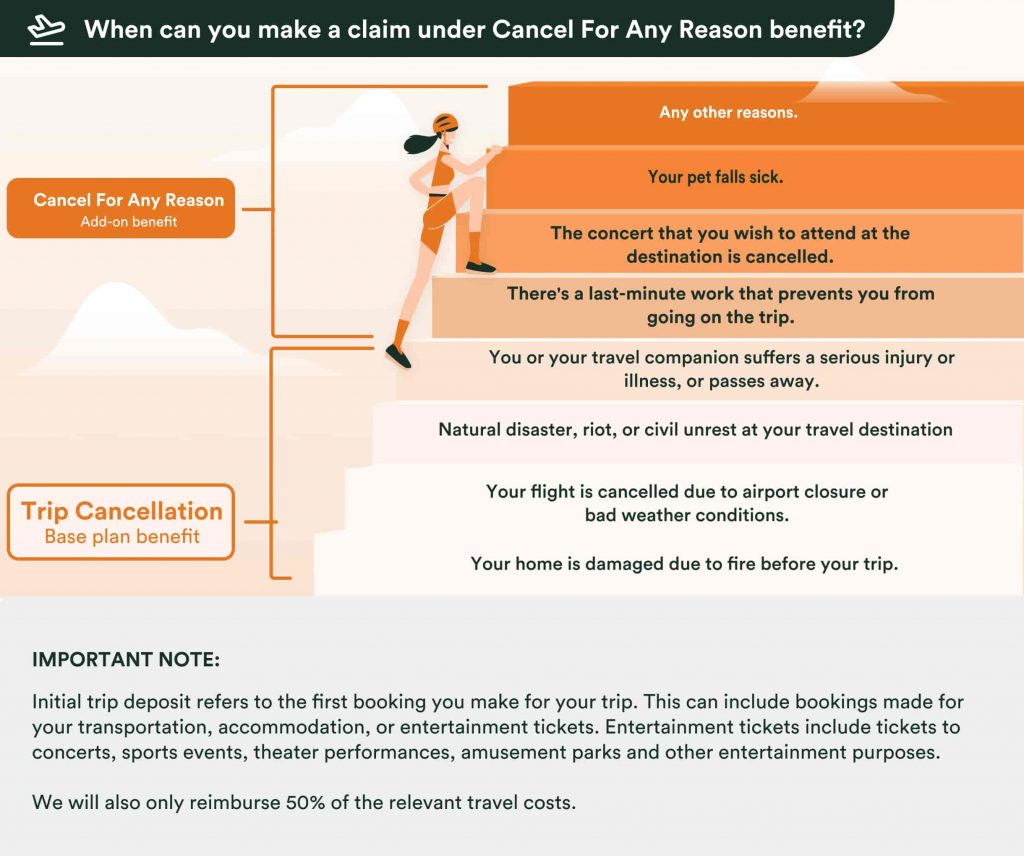

We have enhanced our FWD Travel insurance by introducing a new add-on coverage called Cancel For Any Reason Cover, also known as ‘cancel for any reason’ coverage, this optional benefit extends beyond the usual list of covered events, providing you with enhanced financial protection for unforeseen events.

Cancel For Any Reason Cover has three components:

– Trip cancellation for any reason

– Trip postponement for any reason

– Trip cut short for any reason

With this add-on, you can cancel, postpone, or cut short your trip for nearly any reason, even those that are typically excluded under standard cancellation coverage. Here are some examples of reasons that will be accepted by this comprehensive add-on:

– Reservist training that overlapped with your trip

– Your pet fell sick and required close monitoring

– Unexpected work commitments

– Visa was not processed in time

– Missing your flight due to being stuck in traffic jam

– Concert at destination is cancelled

– Any other reasons not covered in the base plan

This add-on benefit has a broad scope of coverage, but there’s a time frame to note. To enjoy this flexible add-on coverage, you must purchase it within 7 days of making your initial trip deposit.

If you opt for this cover and you have to cancel your trip because of work commitments, you can claim from the add-on, and we will reimburse you up to 50% of all covered travel costs incurred, capped at the maximum benefit limits indicated in the table below. This applies to any unused and irrecoverable prepaid payments or deposits for your travel arrangements.

There are some instances where you might not be covered under the Cancel For Any Reason cover under FWD Travel insurance. For instance, you will not get a payout if you break the law overseas.

Here are some of the general exclusions that still apply:

While the joy of travel is exciting, life’s uncertainties can sometimes cloud our experiences. Cancel For Any Reason, an add-on cover by FWD Travel insurance, ensures you stay financially protected for any situation.

So, whether your travel plans take an unexpected turn, or you simply decide to change them for your convenience, take comfort in the knowledge that you’re financially safeguarded at every stage of your journey.

Learn more about FWD Travel insurance with add-on Cancel For Any Reason and get covered within a few minutes.

This material contains only general information and does not have any regard to the specific investment objectives, financial situation and the particular needs of any specific person. It does not constitute an offer to buy or sell an insurance product or service. Please refer to the exact terms and conditions, specific details and exclusions applicable to General Insurance (Personal Lines) in the policy wordings that can be obtained from our website (https:/www.fwd.com.sg).

Protected up to specified limits by SDIC. This advertisement has not been reviewed by the Monetary Authority of Singapore.