Our top stories across FWD

What is trip cancellation? Does travel insurance allow you to claim for cancel for any reason?

5 min read

5 min read 17 January 2023

17 January 2023We all can agree that getting diagnosed with Cancer can be one of the worst news you can hear from your doctor. And for those who do not have a family history of the disease, you wouldn’t expect to ever be in that situation. When it comes to health, the saying “prevention is better than cure” stays true.

With World Cancer Day coming up on February 4, it is only right that we continue to raise awareness about cancer and encourage detection, prevention and treatment. One of the best ways to stay protected ourselves is to stay informed about Cancer, particularly on the risks and possible prevention measures. The World Health Organisation states that between 30-50% of cancers can currently be prevented by avoiding risk factors and implementing existing evidence-based prevention strategies.

According to the Singapore Cancer Society, with early detection and treatment, you can also have better clinical or management outcomes. It allows less aggressive treatment which leads to the patient’s better quality of life and is related to significantly reduced mortality. That is why being informed is important too. You can only spot when something is amiss if you know the signs to look out for.

Cancer incident rates are different worldwide, affected by various factors such as lifestyle and environment. Here, we discuss common cancers, causes and treatment costs in Singapore and keeping protected.

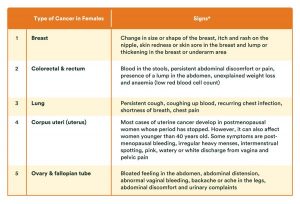

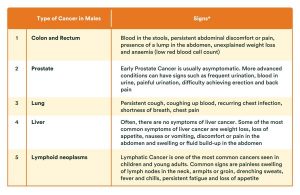

About 1 in every 4 to 5 Singapore residents, male or female, is likely to develop cancer during in his or her lifetime. Knowing the prevalence of certain cancers in Singapore could help you notice the signs of the common cancers, if any of them appear in you or even your loved ones.

Cancer is caused by a mutation of the genes in your cells, which is why there is the misconception that cancer is hereditary. If you have an occurring type of cancer in your family, you may inherit the cancer-causing gene mutation from your parents. This puts you at a higher risk of developing a particular cancer. Some cancers, like breast and colorectal cancer, have a higher chance of being hereditary.

However, inheriting a genetic mutation does not mean you will definitely develop cancer. Approximately 5 to 10 per cent of all cancers are directly caused by inherited genetic mutations.

Gene mutations can also occur from other factors such as exposure to smoking, radiation and other cancer-causing substances. Additional risk factors, like obesity and diabetes, can also increase your chances of developing cancer.

Completely eliminating the chances of developing cancer is unlikely. However, you can help to significantly reduce the risk. In addition to being conscious of the various symptoms, you can actively incorporate positive changes into your lifestyle.

Even without the mention of cancer, smoking is known to be harmful for your body overall. If you smoke, the best thing you can do to prevent cancer is to quit. Unsurprisingly, cigarette smoke contains about 69 different cancer-causing substances and smoking is responsible for 9 out of 10 lung cancer cases.

You might ask, what does food have to do with developing cancer? Eating a variety of fruits and vegetables provides you with essential phytochemicals that keeps your immune system strong, which in turn lowers your cancer risk. With proper intake of nutrition, it also prevents diabetes and obesity, both known to increase chances of cancer. As such, remember to consume plenty of fruits and vegetables in your diet and reduce your intake of red meat, alcohol and sugar.

According to some studies, there is a causal link between physical exercise and the risk of some types of cancer, including colon and breast cancer. A few explanations for this are exercise helps to improve your immune system function, reduces time for food to be digested through the digestive system which decreases exposure to possible carcinogens, and prevents high blood levels of insulin which is linked to cancer development. Exercising helps to prevent obesity too.

On top of a cancer diagnosis, patients also must cope with the reality of how treatment costs may be a financial burden. The type of treatment a patient receives depends on various factors, such as the stage and type of cancer, and the choice of treatment decided between them and their doctor. According to Seedly, in collaboration with the Singapore Cancer Society, treatment costs for late-stage cancer can easily amount to S$8,400 to S$16,700 per month!

Getting insured for cancer can take a rather significant financial load off from you or your family if such a time unfortunately comes. Take FWD Cancer insurance for instance. The plan offers a one-time 100% payout upon a claim for all stages of cancer, allowing you to focus on recovery while ensuring that your financial commitments and those of your loved ones are well taken care of. You can get covered from as low as S$7 a month1, and all it takes is a simple health declaration without any medical examination required. Easily get an FWD Cancer Insurance quote and be protected within minutes.

In support of World Cancer Day on 4 February, FWD is offering special promotions on protection plans. Check out the insurance promotions to find out more!

1For a 30-year-old non-smoking male, with a sum insured of S$50,000 for a one-year renewable plan

*Source: Common Types of Cancer in Singapore (singaporecancersociety.org.sg)

This is for general information only and does not constitute financial advice.

Buying a life insurance policy is a long-term commitment. You should consider if this policy is suitable for your needs, or you may wish to seek advice from a qualified financial adviser before making a commitment to purchase this policy. Switching from an existing policy to a new one may have potential disadvantages.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact FWD Singapore Pte. Ltd. or visit the GIA/LIA or SDIC web-sites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

This advertisement has not been reviewed by the Monetary Authority of Singapore.