Our top stories across FWD

What is trip cancellation? Does travel insurance allow you to claim for cancel for any reason?

8 min read

8 min read 14 March 2019

14 March 2019Most people say planning is winning half the battle, but how does that apply to our health? When it comes to keeping healthy, most people eat healthily and exercise as much as possible.

While these are commendable, can we do more to prepare ourselves for any unexpected health episodes? Of course, we can.

While most people today mitigate for these unforeseen circumstances by protecting themselves with insurance, many still do not do enough, especially when it comes to critical illnesses like cancer, the number one killer in Singapore.

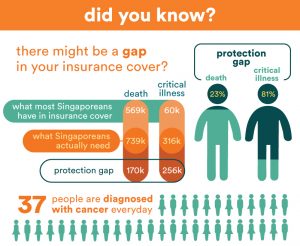

Considering the high risk surrounding cancer, having comprehensive cover can be very beneficial. The next question people may ask is, just how much cover is enough? See our simple infographic below to have a good idea:

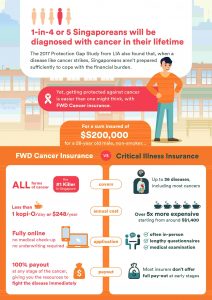

Below is another infographic that shows a simple comparison between insurance products available to Singaporeans today.

Insurers like FWD Singapore offer benefits that may be more fitted to your budget and concern if compared to the estimated cost of critical illness coverage.

With FWD, you get a full payout for all stages of cancer, ensuring you have the financial means to beat the disease, regardless of its type or stage.

No medical examination required. Just a simple questionnaire on your health condition to get the cover you need: All you need to let FWD know is your gender, age and whether you are a smoker. No lengthy medical history declaration required.

Stress-free and convenient claims. To make a claim, provide evidence from a certified medical examiner or doctor stating that you suffer from cancer. That’s it. A quick and easy claims procedure means you can embark on the necessary treatment without delay.

Free medical second opinion. A benefit that allows you to seek a second medical opinion on your diagnosis and treatment plan, helping ensure you receive the most suitable care for your condition.

Different people have different priorities, and it’s good to know that there are options that cater to different protection needs too. Beating cancer can be a challenging journey, having yourself insured provides an extra layer of protection should you wish to secure your peace of mind. Learn how FWD Cancer insurance can support you.

Information is meant purely for informational purposes and should not be relied upon as financial advice. Terms and conditions apply. Protected up to specified limits by SDIC. This advertisement has not been reviewed by the Monetary Authority of Singapore.