Our top stories across FWD

What is trip cancellation? Does travel insurance allow you to claim for cancel for any reason?

5 min read

5 min read 4 July 2024

4 July 2024Nothing beats travelling to our favourite holiday destination with the assurance that we are covered for unexpected events, such as overseas medical costs.

However, some of us who are looking for travel insurance but have pre-existing medical conditions may be hard-pressed to purchase a comprehensive travel insurance plan. After all, most travel insurance policies exclude coverage for pre-existing conditions.

This feature may be especially relevant to Singaporeans given the increased incidences of health conditions1, such as hypertension.

Here’s the best news: you can now enjoy comprehensive travel insurance coverage even if you have pre-existing health problems with FWD’s optional Pre-existing Medical Conditions cover.

A pre-existing medical condition refers to a medical condition that you are aware of, or should reasonably be aware of, before the start of your trip; or that you received medical advice, treatment, diagnosis, or prescription drugs up to 12 months before the start of your trip. Some common pre-existing medical conditions include asthma, high blood pressure, diabetes, and hypertension.

Do note that if you’ve made a claim related to a medical condition during a previous trip on an annual plan, that same condition will be considered as a pre-existing medical condition for any future trips.

The Pre-existing Medical Conditions cover is an optional add-on to your standard travel insurance policy. If you opt for this cover, we’ll reimburse you for claims directly related to pre-existing medical conditions suffered by you, a family member travelling with you, or your travel companion (where applicable). These conditions, which fall under the covered benefits, must impact your trip.

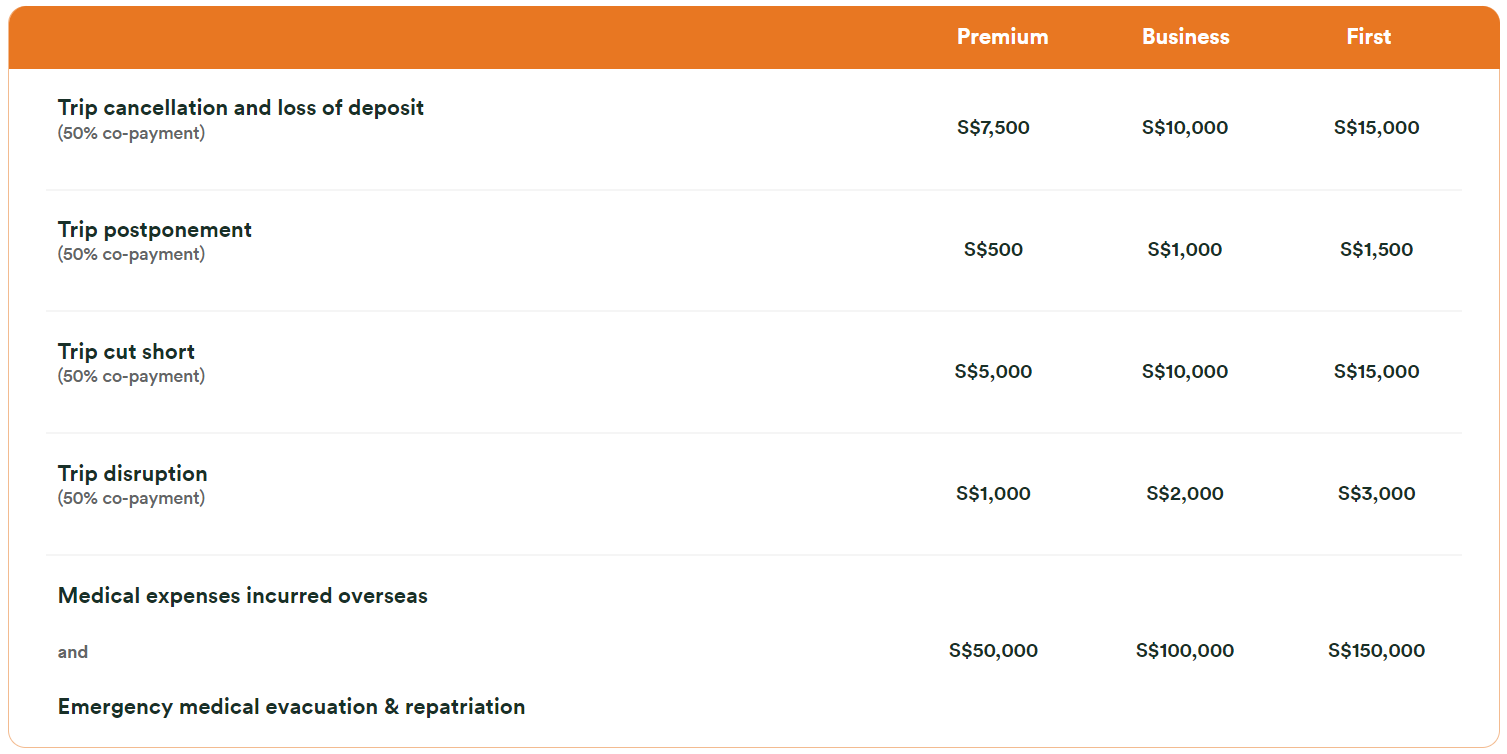

You can claim from one of the following benefits under the Pre-existing Medical Conditions cover:

It can be a real bummer to cancel your holiday trip due to a pre-existing health condition. Here’s where this benefit can come in handy. We’ll pay this benefit if your entire trip is cancelled due to a pre-existing medical condition within 30 days before your scheduled departure date. The cancellation must be directly linked to the condition.

For the trip cancellation and loss of deposit benefit, any new medical condition that arises within 30 days before your scheduled departure date will not be considered a pre-existing condition. This rule applies to you, your family members, and your travel companions.

Even if your trip isn’t fully cancelled, the feeling of pushing back your holiday after weeks of intense planning can be a let-down. Worse still, there may be itinerary costs incurred or accommodation deposits that you may have to forfeit. Rest assured: we’ll pay this benefit if your entire trip is postponed due to a pre-existing medical condition within 30 days before your scheduled departure date. The postponement must be directly linked to the condition.

Nobody likes to shorten a trip that has taken months of planning. Should something happen to you as a direct result of the pre-existing medical condition, rest assured that we will pay this benefit if you have to return immediately to Singapore before your scheduled return date.

Sometimes, you may have to change your itinerary and opt for less intensive activities because of your pre-existing conditions. We will pay this benefit if your trip is disrupted due to a serious injury or illness as a direct result of a pre-existing condition; we’ll cover the necessary itinerary changes. A local medical practitioner’s confirmation on the accident or diagnosis is required.

Overseas medical treatment expenses can come with a hefty price tag. With this benefit, we’ll cover unexpected illness or injury treatment directly related to a pre-existing condition while you’re overseas.

Sometimes, there may be certain situations that happen that require medical evacuation or repatriation. The assurance you can have is that we are here for you even in these circumstances. You can claim this benefit if you suffer from a life-threatening condition as a result of an unexpected illness or injury directly due to a pre-existing medical condition that happens while overseas on a trip, and: we believe it is medically necessary to move you to a medical facility in Singapore or overseas; or you need to return to Singapore for continued treatment after having been moved to an overseas medical facility for treatment; or if you pass away while you are overseas.

If you’re medically unfit to travel or confined to a hospital overseas due to a pre-existing condition, we’ll extend your policy period, at no extra cost. A medical practitioner must confirm this in writing while you are overseas.

There are some factors to consider when we’re purchasing a travel insurance plan that covers pre-existing conditions. This ensures that you can enjoy a seamless claims process should your trip be disrupted due to a pre-existing medical condition. Some points to note include:

Do take note that the Pre-existing Medical Conditions cover is valid for Single trip plans, for up to 30 days only.

Some common exclusions for the pre-existing conditions cover include:

It’s important to carefully review the policy wording and understand the exclusions that may apply to your pre-existing conditions.

Securing the right travel insurance for pre-existing conditions is essential for your peace of mind while traveling. By understanding your pre-existing conditions, considering the factors that matter to you, and asking the right questions, you can find a policy that provides the necessary coverage and protection.

If you are looking for a travel insurance plan that covers pre-existing conditions, you are in the right place. With the Pre-existing Medical Conditions cover, you can get coverage for pre-existing conditions such as asthma, diabetes, high blood pressure and more for Single trip plans, with up to S$150,000 coverage for medical expenses incurred overseas.

References:

1Based on National Population Health Survey 2021/22 : https://hpb.gov.sg/community/national-population-health-survey/survey-findings