Our top stories across FWD

What is trip cancellation? Does travel insurance allow you to claim for cancel for any reason?

5 min read

5 min read 21 October 2019

21 October 2019Cancer is the leading cause of death in Singapore, with one in five Singaporeans likely to contract some form of it in their lifetime. That’s an average of 35 people diagnosed every day. While these statistics may be startling, there are ways to safeguard yourself from the illness — and ensure you are financially protected in the face of adversity.

Known causes of cancer include smoking, excessive exposure to UV rays from the sun, accumulated radiation exposure from X-rays or CT scans, and one’s genetic makeup.

Figures from the Ministry of Health between 2016 and 2018 show that cancer caused an average of 29.4% of deaths in Singapore. According to the Singapore Cancer Society, these are the ten most common forms of cancer in men and women:

Source: Singapore Cancer Society

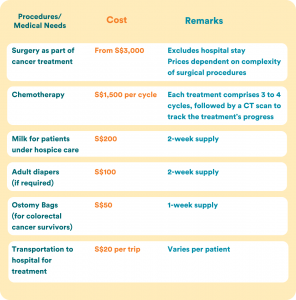

The estimated costs of cancer treatment are high, as this breakdown shows.

Source: Seedly (adapted) Do note that the above numbers are based on the average amount of subsidies that Singapore Cancer Society provides to needy cancer patients. it is not meant to be an exhaustive or definitive list of examples.

There are many types of critical illnesses, such as cancer, heart disease, stroke, kidney failure and more.

Did you know:

Early detection of cancer and proper treatment early on can greatly increase the chances of survival. This is where early insurance payout helps. If you have a critical illness plan, do check the terms to see if early stage cancer is covered and how much it covers.

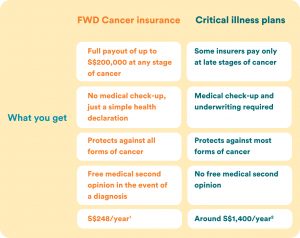

Cancer insurance is a benefit policy, this means that the claims payout is made when a certain covered event occurs, regardless of whether the patient is making a claim from another insurer or not. The table below shows the key differences between FWD’s Cancer insurance and what some other critical illness plans may offer:

¹ ² Are You Prepared to Beat Cancer When It Strikes?

Critical illness plans cover an extensive list of illnesses, and premiums can go up to thousands depending on your preferred coverage. In addition, to cover early stage critical illnesses, one may have to pay an additional premium to enjoy this cover. If affordability is an issue, standalone plans such as Cancer insurance can provide protection for specific critical illnesses without breaking the bank.

According to the Ministry of Health, Singapore, cancer is the number one cause of death every year from 2016 to 2018, accounting for nearly 30% of deaths. A typical cancer insurance cover costs just an estimated 20% of most critical illness plans, providing a much more affordable option for those looking to get covered for this condition.

While cancer is caused by a combination of factors, eating right and getting adequate exercise are some easy ways to ensure your physical and mental health remain at optimum levels.

Make it a point to clock at least 150 minutes of physical activity weekly, whether it be doing household chores, brisk-walking or taking the stairs more regularly. The Health Promotion Board also recommends getting 7 to 9 hours of sleep daily, although this varies by age.

Consider protecting yourself further with FWD Cancer insurance, which could help safeguard you for all types and stages of cancer, even for early stages — in addition to any existing critical illness plan you may have. Ultimately, safeguarding your health early will benefit you in the long run.

Information is meant purely for informational purposes and should not be relied upon as financial advice. Protected up to specified limits by SDIC. This advertisement has not been reviewed by the Monetary Authority of Singapore.